A tailored solution perfect for you.

Your money, your Superannuation

gives you the freedom to support the lifestyle you choose at retirement.

What is your most appropriate superfund?

What is a transition to retirement pension and is it suitable for me?

What is the difference between a retail fund and an industry fund?

Should I salary sacrifice or should I make additional mortgage repayments?

Call Blue Summit Financial Solutions today.

Blue Summit enquiries

Call 1300 BLU SUM (1300 258 786) or email office@bluesummit.com.au

A tailored solution perfect for you.

Retail VS Industry VS SMSF

Australia’s Superannuation and retirement income system has a complicated history.

The first industry-specific Superannuation fund is believed to have been started by the union body of the construction, building and allied industries and was known as the ‘Construction and building Union Superannuation’ or ‘CBUS’ in 1984. It is thought to be one of the first initiatives of its kind. Funds were owned and controlled by a board comprising equal numbers of employer and employee or union representatives. Similar industry-specific funds were established in the following years, for example, teachers, mining, and car manufacturing. These funds became known as ‘Industry Funds’.

In the early/late 1980s, those funds were not ‘portable’, meaning you only had access to those funds provided you stayed with your employer and remained in the industry. Over the years, those rules have been relaxed, and industry funds are open to all Australians. According to legislation, industry super funds can only use their profits to benefit members.

The rise of retail Superannuation funds occurred in the 1990s after the Federal government legislated compulsory Superannuation contributions. Retail Superannuation funds are managed by banks and other financial institutions and are beholden to investors and shareholders.

Industry funds can tend to invest in unlisted property and infrastructure such as power stations, airports, and private equity. In contrast, retail funds are more likely to gain that exposure through listed assets such as real estate investment trusts and Australian and international shares.

Given the difference in exposure to unlisted assets, industry funds may appear to have more robust, less volatile returns over the short term as their assets may not be valued in the same way as those listed assets. On the flip side, those retail funds with a greater weighting towards listed assets recovered more quickly from the Global Financial Crisis.

In 1999, legislation was passed to allow for small member Superannuation funds and the ‘self-managed’ super fund was born. This is an ever-increasingly popular choice, although serious consideration needs to be given to the administrative burden this type of fund brings.

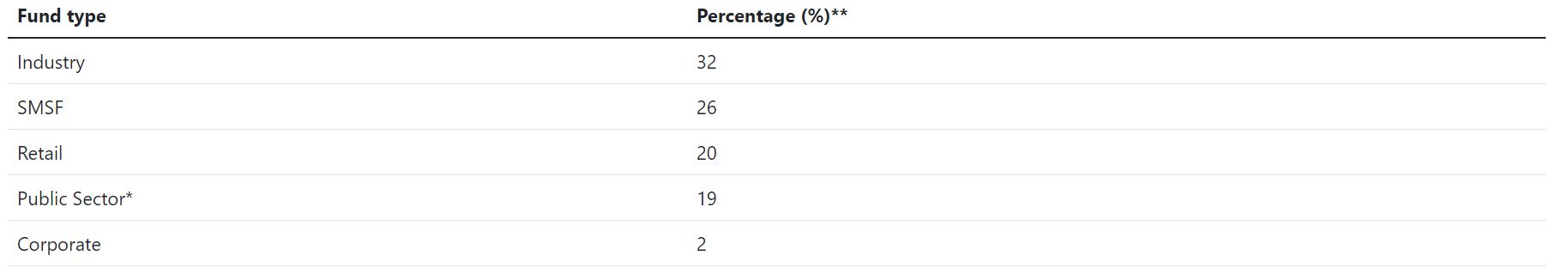

As of March 2022, the Australian Superannuation system holds over $3.4 trillion, with money being spread roughly as follows:

*Public sector funds are only open to those working in the public sector **The missing 1% relates to Statutory Funds and is outside the scope of this article.

Your Superannuation is your money; it is crucial to know where it is and why it is there. If you have any questions about your Superannuation, please give us a call.

Growing your Super

Growing your Superannuation can seem too complicated and out of your control. Investment options can be confusing and complex; however, by reflecting on a few personal questions with your financial adviser, the decisions can seem less daunting. For instance, what are your:

- Personal goals,

- Age,

- Financial position,

- Investment experience,

- Investment goals,

- Timeframe for investing, and

- Comfort with volatility?

Have you heard of the term “risk tolerance”? Put simply; your risk tolerance is your emotional tolerance for financial risk. Some people are born risk takers, willing to put everything on the line for a greater return, while others cannot sleep at night with worry and anxiety about losing money. Your risk tolerance is personal and suitable for you.

A financial planner uses tools like questionnaires, lifecycle analysis and sensitivity analysis to understand your situation better. For example, we ask you to choose from a range of answers in response to questions like:

- What is your primary objective? This could include a goal of maintaining your capital while giving you a regular income, or maybe you are aiming to receive the greatest return on your investments.

- What would be your first thought if your investments fall by 20% in a year? Your response could either be to panic and withdraw the remaining funds, or you might have the opposite reaction and think, fantastic, it’s a sale. I will increase my portfolio while the market is cheaper.

Once we have identified your attitude to risk, we can determine how much of each asset class (such as shares, term deposits or bonds) should be used when creating your investment portfolio. The government website ‘Money Smart’ confirms that most super funds let you choose from various investment options.

Options usually include:

- Growth

- Balanced

- Conservative

- Cash

- Ethical

- MySuper

Unfortunately, not every Superannuation fund has the same asset weightings for an investment option with the same name. For example, balanced funds can have vastly different allocations between growth and conservative investments. This can make it challenging to compare one Superannuation option with another. We can help you undertake an in-depth analysis to answer any questions you may have.

It is also essential to understand that your attitude to risk may change over your lifetime. Often, during periods of economic boom, people disregard risk and forget that markets can fall. However, during an economic depression, people become more conservative because they only see financial losses. Therefore, your risk profile is not a static phenomenon but dynamic, requiring objective guidance during your investing.

Growing your Superannuation is vitally essential to ensure your retirement works for you. See us today to chat about your Superannuation and start making it work harder for you.

Some benefits of Superannuation

In its current form, Superannuation has been around for approximately 30 years, so many of us are familiar with what it is and its intention – to provide for our retirement. However, the Superannuation system in Australia provides other benefits that you can access with the help of your trusted financial adviser. This will ensure your Superannuation is working as hard as you are while you are at work and during your retirement.

1. Pay less income tax

Under the guidance of your financial adviser and in conjunction with your employer, you can sacrifice a portion of your salary into Superannuation. The result is that your contribution may be taxed at just 15% instead of paying your usual income tax rate, provided your salary is less than a certain amount annually. Voluntary after-tax super contributions may also be beneficial. Additionally, you may be able to claim a tax deduction for these contributions. This strategy has limitations (Superannuation contribution caps), so care must be taken. Also, it’s important to remember that once the funds are in the Superannuation system, they can only be accessed once you satisfy a condition of release.

2. Pay less tax on investment returns.

Any investment outside of Superannuation that earns you an income will be taxed at your marginal tax rate. Assets held within Superannuation, however, are treated differently, with the profit earned during the accumulation phase generally taxed at only 15%. Naturally, those savings must remain in Superannuation until you retire.

3. Tax-free income at retirement

After you turn 60 and retire, you may be able to access your Superannuation without paying tax. This tax-free status may apply to money taken via an income stream or lump sum.

4. Ensure your super goes to the right person

For most Australians, their Superannuation account is their second largest asset after their family home. Many people do not know that this asset does not automatically form part of their estate, so a Will may not cover it upon death. A binding death benefit nomination form is required. This form will ensure that your Superannuation goes to the person of your choice.

5. Your super may be protected from bankruptcy.

Provided your Superannuation is held in a regulated super fund, bankruptcy may not impact your Superannuation savings. Consequently, your Superannuation may be protected from creditors.

6. Notable boost from the government

Suppose you’re not on a high income and make voluntary after-tax Superannuation contributions. In that case, you may be able to increase your account balance by benefiting from the federal government co-contribution.

7. Potentially cheaper life insurance cover

Finding spare money to pay for life insurance in your after-tax weekly budget can be difficult. By holding your life insurance in your Superannuation, your insurance premiums may be able to be automatically paid from your Superannuation account. Your super fund claims a tax deduction for those premiums, and you can, in turn, benefit from that.

Superannuation is your money; talk to us today to ensure you make the most of the opportunities to maximise your benefits.